how are property taxes calculated in orange county florida

This Supplemental Tax Estimator is provided for you to estimate the potential amount of supplemental tax on a given property. The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales tax.

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Groceries are exempt from the Orange County and Florida state sales taxes.

. To calculate the property tax use the following steps. 3 discount if paid in December. These directives are designed to support evenness everywhere in Florida.

The millage rate for Boca Raton is 18307 per 1000 of value so you are paying. Tangible Personal Property Taxes are mailed to property owners by November 1 of each year. 2 discount if paid in January.

The full amount of taxes owed is due by March 31. The present market worth of real property situated in your city is determined by Orange County appraisers. The median property tax on a 22860000 house is 221742 in Florida.

Ad Property Taxes Info. Some information relating to property taxes is provided below. Orange County calculates the property tax due based on the fair market value of the home or property in question as determined by the Orange County Property Tax Assessor.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Property taxes in Orange County are levied annually and calculated by multiplying the assessed value of a property by the areas. If Orange County property taxes have been too.

The median property tax also known as real estate tax in Orange County is based on a median home value of and a median effective property tax rate of 094 of property value. Florida real property tax rates are implemented in millage rates which is 110 of a percent. Street Number 0-999999 or Blank.

The median property tax on a 22860000 house is 214884 in Orange County. The average property tax rate in Florida is 083. Each county sets its own tax rate.

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The following early payment discounts are available to Orange County taxpayers. The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943.

Property taxes apply to both homes and businesses. Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499. Key in the Parcel Number OR Property Address below and Click on the corresponding Find button.

When it comes to real estate property taxes are almost always based on the value of the land. This simple equation illustrates how to calculate your property taxes. Once again Florida has mandated statutory rules and regulations which county real estate appraisers must carry out.

Find the assessed value of the property being taxed. One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value.

The Orange County Sales Tax is collected by the merchant on all qualifying sales made within Orange County. There are also special tax districts such as schools and water management districts that have a separate. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

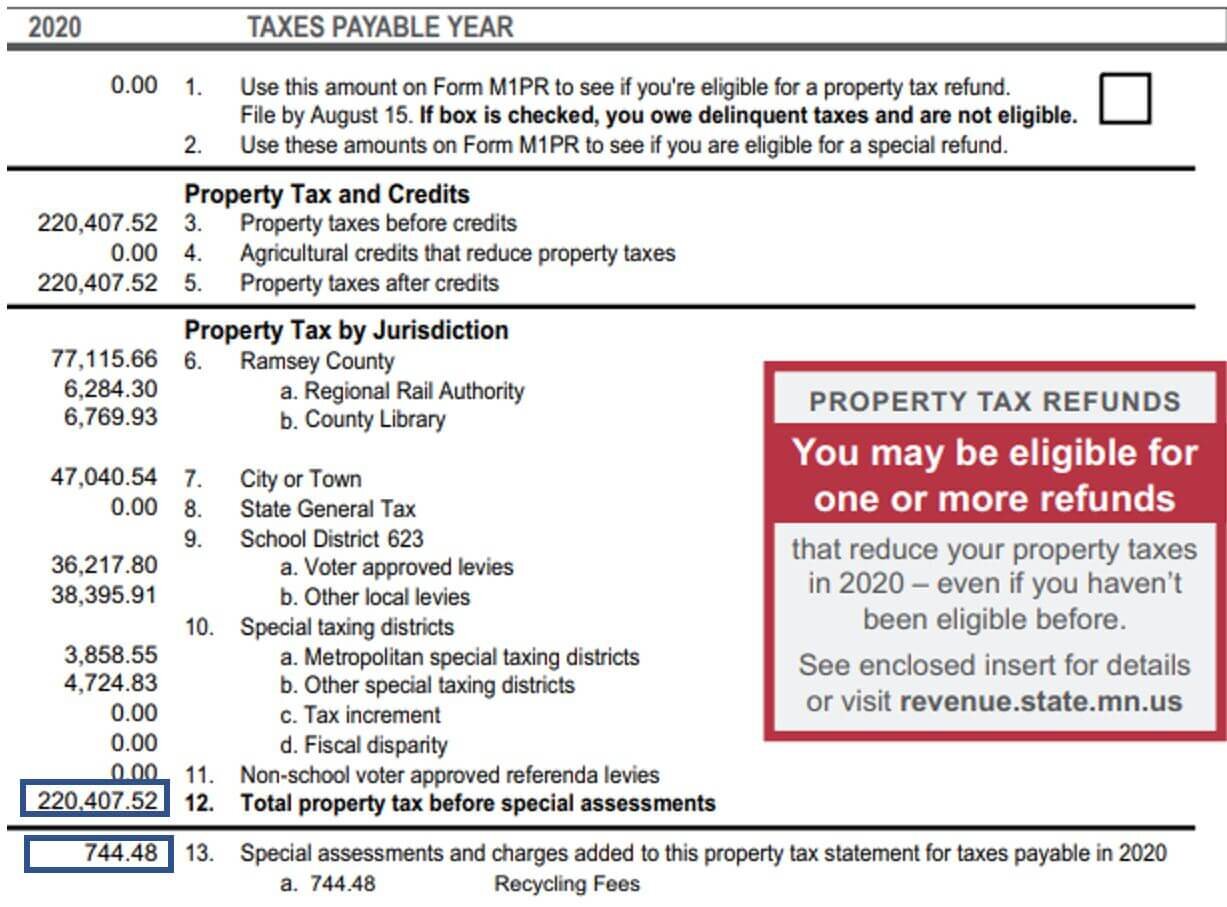

Bill of Property Tax Orange County. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes.

Now in this part the page shows the Orange County Property Tax bill with its respective value date and tax rateOrange county property tax rate is calculated by the government and varies according to the area. See Results in Minutes. Florida property owners have to pay property taxes each year based on the value of their property.

Orange County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Search Any Address 2. Street Number 0-999999 or Blank East North North East North West South South East South West West.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. This equates to 1 in taxes for every 1000 in home value. Select East West South North Southeast Southwest Northeast Northwest.

The millage is 7 mills for county schools and 11 mills for all non-school taxing authorities combined city county and special districts. 4 discount if paid in November. The bill can be downloaded printed and paid at any bank.

Enter Any Address Receive a Comprehensive Property Report. The rates are expressed as millages ie the actual rates multiplied by 1000. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years.

With an average tax rate of 094 Orange County Florida residents pay an average of 2152 a year in. The median property tax on a 22860000 house is 240030 in the United States. Orange County Property Tax Rates Photo credit.

City of Orlando Property Tax Search Calculator. The more valuable the land the higher the property taxes. Do not enter street types eg.

SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. Of the sixty-seven counties in. See Property Records Tax Titles Owner Info More.

How are property taxes calculated in Orange County Florida. The Orange County average property tax rate is 094 which is slightly below the national average. Property values are usually determined by a local or county assessor.

1 discount if paid in February.

Who Pays The Transfer Tax In Orange County California

Https Www Iii Org Article How To Save Money On Your Homeowners Insurance Home Buying Process Home Equity Loan Home Equity

Faqs Office Of The Clay County Property Appraiser

See How Low Property Taxes In Florida Are Stacker

A Guide To Underwriting Multifamily Property Tax Tactica Real Estate Solutions

California Public Records Public Records California Public

The Sparefoot Blog Moving Storage And Organization Advice Rent Vs Buy Home Buying Real Estate Tips

The Ultimate Guide To North Carolina Property Taxes

Vermont Property Tax Calculator Smartasset

The Best And Worst U S Cities To Retire Retirement Retirement Advice Retirement Finances

Homeowners Florida Homestead Check

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Calculate Your Tax Bill

Property Tax Constitutional Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Sales Tax In Orange County Enjoy Oc

Estimating Florida Property Taxes For Canadians Bluehome Property Management